Of the last 3 years, 2024 showed the slowest growth.

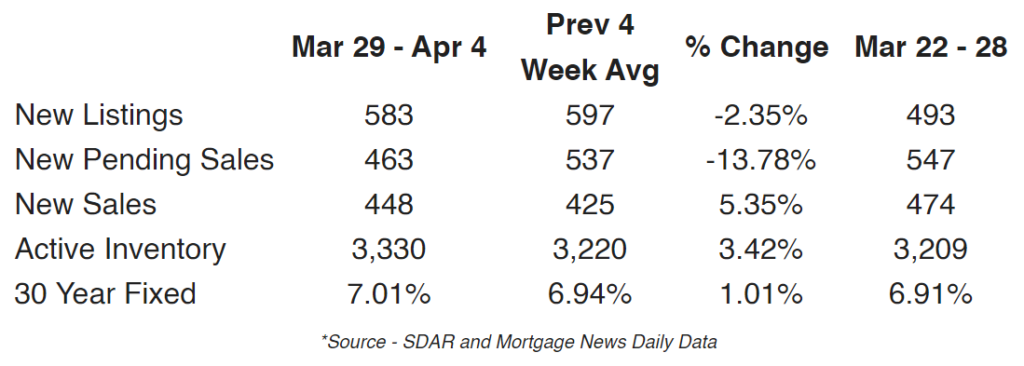

New listings ended the 2-week slump that appears to have had more to do with Spring Break than the NAR settlement or anything else.

Weekly new pendings pulled back well below 500 after the previous 5 weeks had averaged nearly 540.

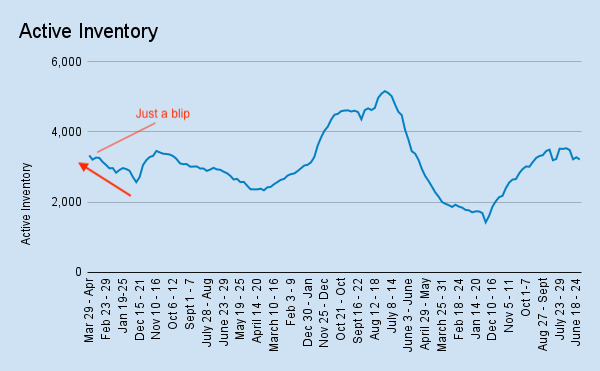

Active inventory returned to its upward trend as a result.

The end of March also brings with it the end of the first quarter of 2024 – I have some interesting data below comparing how Q1 2024 did against the previous two Q1s.

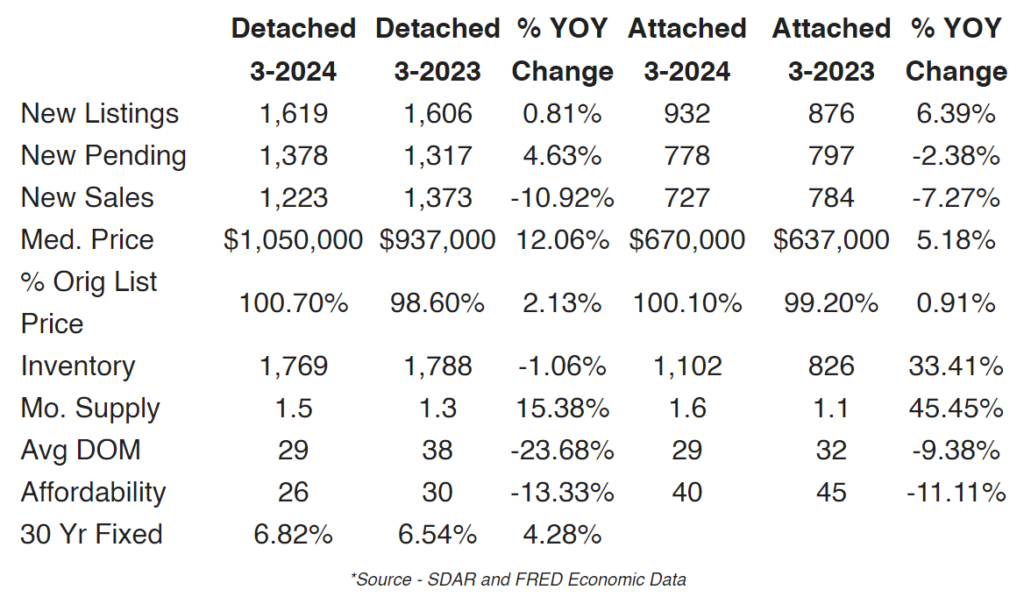

Let’s start with what values did in March though…

As a reminder we saw 6.3% combined (attached and detached) month-over-month appreciation in February…that’s astronomical.

March saw much more subdued (healthier) increases in detached (+0.58% – $1,050,000 in March, up from $1,043,900 in February) and attached median prices (+1.21% – $670k in March, up from $662k in February).

Despite those increases, SDAR is showing a combined median price for March at the same level as February ($890k). Another example of the oddities of the median price calculation.

My preferred measure of values, the combined median price per sq ft, increased from $578 in February to $583 in March (+0.87%).

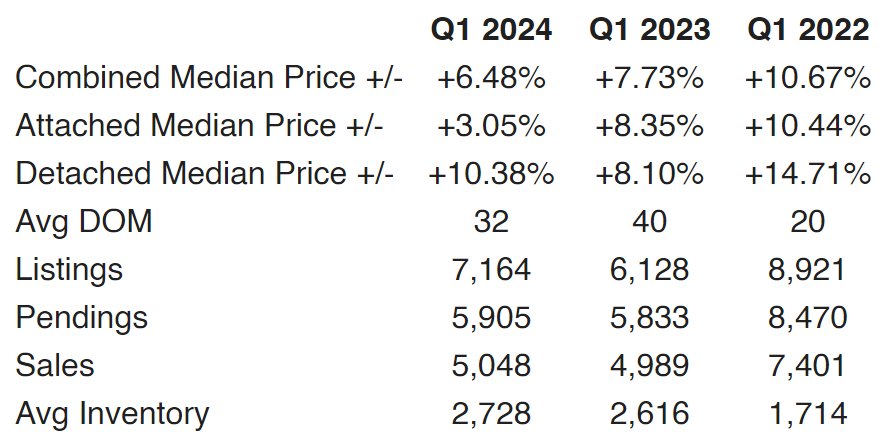

So how did Q1 shake out compared to 2023 and 2024?

Q1 has made a lot of San Diegans a lot of equity in the past 3 years!

Of the last 3 years, 2024 showed the slowest growth but considering that much of the country is seeing home prices relatively stagnant (and even dropping), this quarter’s data is almost more impressive.

San Diego’s unemployment rate stayed at 4.7% in the most recent March update (February data).

Job creation rebounded which is a good sign for the local economy. The labor force increased as well which is why the unemployment rate didn’t go down.

How’s Brian feeling this week about the San Diego market?

Optimistic, but still playing it cautiously…

- 3-month outlook (June 2024) – inventory will increase. We’ll see another 1-2% appreciation over March in Q2. Values will peak in May, then flatten out and fall from there.

- 6-month outlook (September 2024) – inventory will be higher still. I expect demand to continue to slow with rates staying higher for longer. Q3 will show a little depreciation as buying starts slowing down in July. Values will be close to levels seen in March 2024.

- 12-month outlook (March 2025) – we usually lose 3-5% in from the end of Q3 to the end of Q4 (even in good years) then gain it all that back and more in Q1. I don’t see why this year will be any different. We’ll end up 3-5% higher in March 2025 compared to today’s levels.

Disclaimer! This is not investment advice. I might be wrong. You make your own decisions.

Other Relevant Local News

- The proposed future design for the Ocean Beach Pier design was revealed on Saturday.

- California consumer outlook drops to 11 year low.