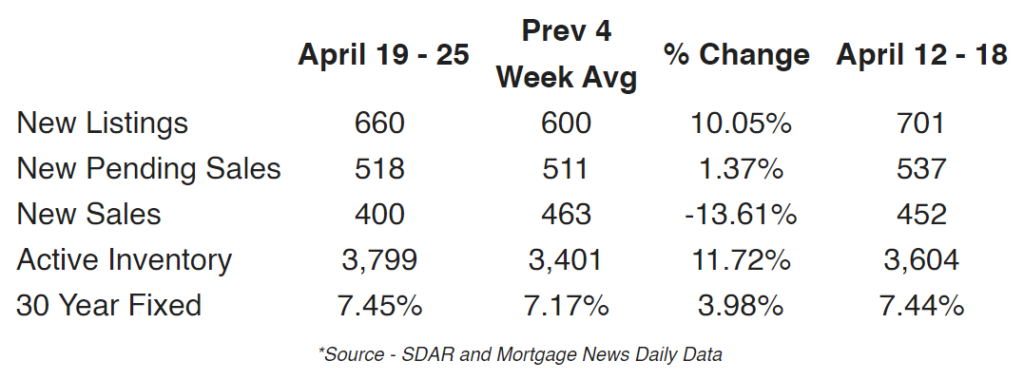

While some properties are still seeing multiple offers and well over asking, that is becoming the exception and not the rule.

New listings continue to out-pace weekly new pendings.

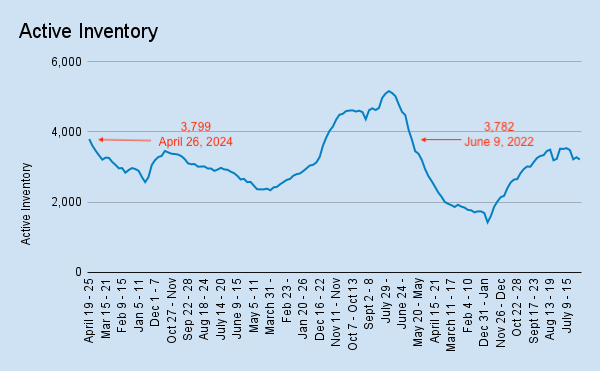

Inventory is rising fast as a result, up 195 from the week prior and at the highest mark we’ve seen since June 2022.

The market is cooling off. While some properties are still seeing multiple offers and well over asking, that is becoming the exception and not the rule.

I can confidently say that prices will be falling from here, but that reality likely won’t show up in the median price data until June (possibly May).

How’s Brian feeling this week about the San Diego market?

Not optimistic anymore…

- 3-month outlook (June 2024) – inventory will increase. We’ll see another 1-2% appreciation over March in Q2. Values will peak in April, then flatten out and fall from there.

- 6-month outlook (September 2024) – inventory will be higher still. I expect demand to continue to slow with rates staying higher for longer. Q3 will show some depreciation as buying starts slowing down in July. Values will be close to levels seen in March 2024.

- 12-month outlook (March 2025) – we usually lose 3-5% in from the end of Q3 to the end of Q4 (even in good years) then gain it all back and more in Q1. It all depends on rates, and that’s such a crap shoot to try to nail down right now. I plead the 5th for now.

Disclaimer! This is not investment advice. I might be wrong. You make your own decisions.

Other Relevant Local News

- Oceanside has approved new short-term rental cap & restrictions.

- Area around Oceanside Pier reopens after devastating fire.