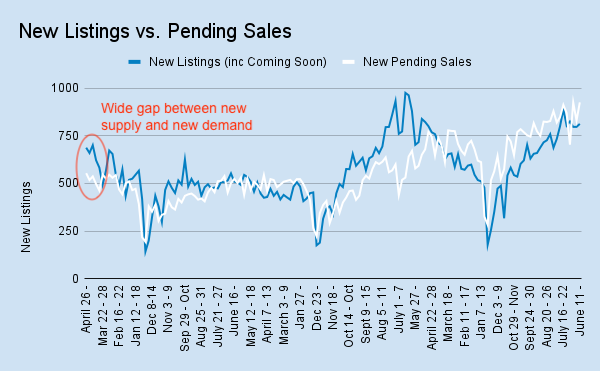

New listings increased. And surprisingly, despite higher rates (until Friday), so did new pending sales.

Activity is picking up across the board.

New listings increased. And surprisingly, despite higher rates (until Friday), so did new pending sales.

The gap remains wide with new listings outpacing new pending sales.

When that gap has existed for an extended period in the past, prices have moderated or fallen soon after.

I’d consider us in “extended period” territory now.

As is par for the course, new sales spiked during the last week of the month.

We’ll have all the final April data by next week so stay tuned for the monthly update next Tuesday.

The local labor market is looking a little better after last month’s update. March showed that the San Diego region’s unemployment rate fell to a much more palpable 4.4%, down from 4.8% in February.

That’s up from 3.5% from one year ago – so, we’re still “weaker” by comparison, but not a “weak” job market by any means.

Job creation was strong in the government, hospitality, and construction sectors.

The high-paying professional services sector showed the biggest month-over-month decline.

How’s Brian feeling this week about the San Diego market?

Not optimistic anymore…

- 3-month outlook (June 2024) – inventory will increase. We’ll see another 1-2% appreciation over March in Q2. Values will peak in April, then flatten out and fall from there.

- 6-month outlook (September 2024) – inventory will be higher still. I expect demand to continue to slow with rates staying higher for longer. Q3 will show some depreciation as buying starts slowing down in July. Values will be close to levels seen in March 2024.

- 12-month outlook (March 2025) – we usually lose 3-5% in from the end of Q3 to the end of Q4 (even in good years) then gain it all back and more in Q1. It all depends on rates, and that’s such a crap shoot to try to nail down right now. I plead the 5th for now.

Disclaimer! This is not investment advice. I might be wrong. You make your own decisions.

Other Relevant Local News

- San Diego tops the US in home price gains for 3rd month straight.